san francisco gross receipts tax due date 2022

Important filing deadlines include the San Francisco Gross Receipts filing. The three taxes are the San Francisco Gross Receipts Tax the Homelessness Gross Receipts Tax and the Commercial Rents Tax.

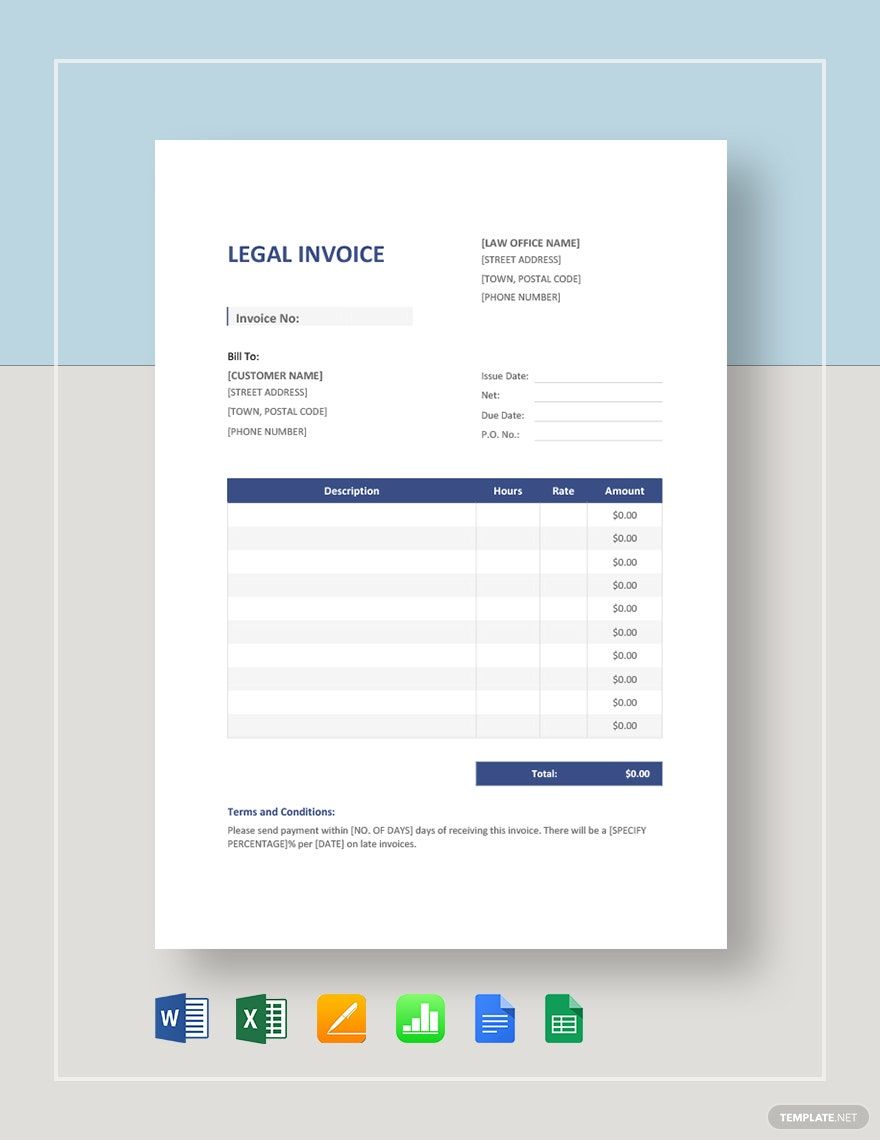

Invoice And Accounting Software For Small Businesses Freshbooks

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax.

. The Gross Receipts Tax small business exemption threshold is 2000000 of combined gross receipts within the City. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office.

The changes are reflected in the 2021 Annual Business Tax filings due February 28 2022. The Homelessness Gross Receipts Tax is applied to combined San. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax.

San francisco property tax due dates 2022. Processing time may take up to 3-5 business days. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

Due to COVID-19 the San Francisco Board of Supervisors has changed the due dates of certain business taxes and license fees. Additionally businesses may be subject to up to three city taxes. Who is subject to San Francisco gross receipts tax.

Business license renewal due for the SF Office of the Treasurer and Tax Collector Department of Health. Annual Business Tax Returns 2021 File by Feb. The penalty structure for all business taxes and fees for tax years 2020 and prior.

San Francisco pushes back business registration due date. You will be unable to renew online without your PIN. City and County of San Francisco.

San Francisco businesses are also subject to annual registration fees based on San. The Gross Receipts Tax is filed as part of the Annual Business Tax Return. Down from 0829 for tax year 2016.

San francisco property tax due dates 2022 ddo dimension door clicky July 7 2022 0. The filing obligation and tax rates for all. Businesses that qualify for the First Year Free program but start before July 1 2022 will be required to pay 2022-23 business registration fees fees for the 2021-2022 year will be waived.

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. The 2017 gross receipts tax and payroll expense tax return is due. The rates generally are increased again for the 2022 2023 2024 tax years and beyond.

Posted on July 7 2022 by. You will need the following information to complete the renewal and to calculate the. Feb 28Payroll Expense Tax and Gross Receipts Tax returns due Mar 31.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

Zafar Associates Llp Income Tax Returns Pakistan

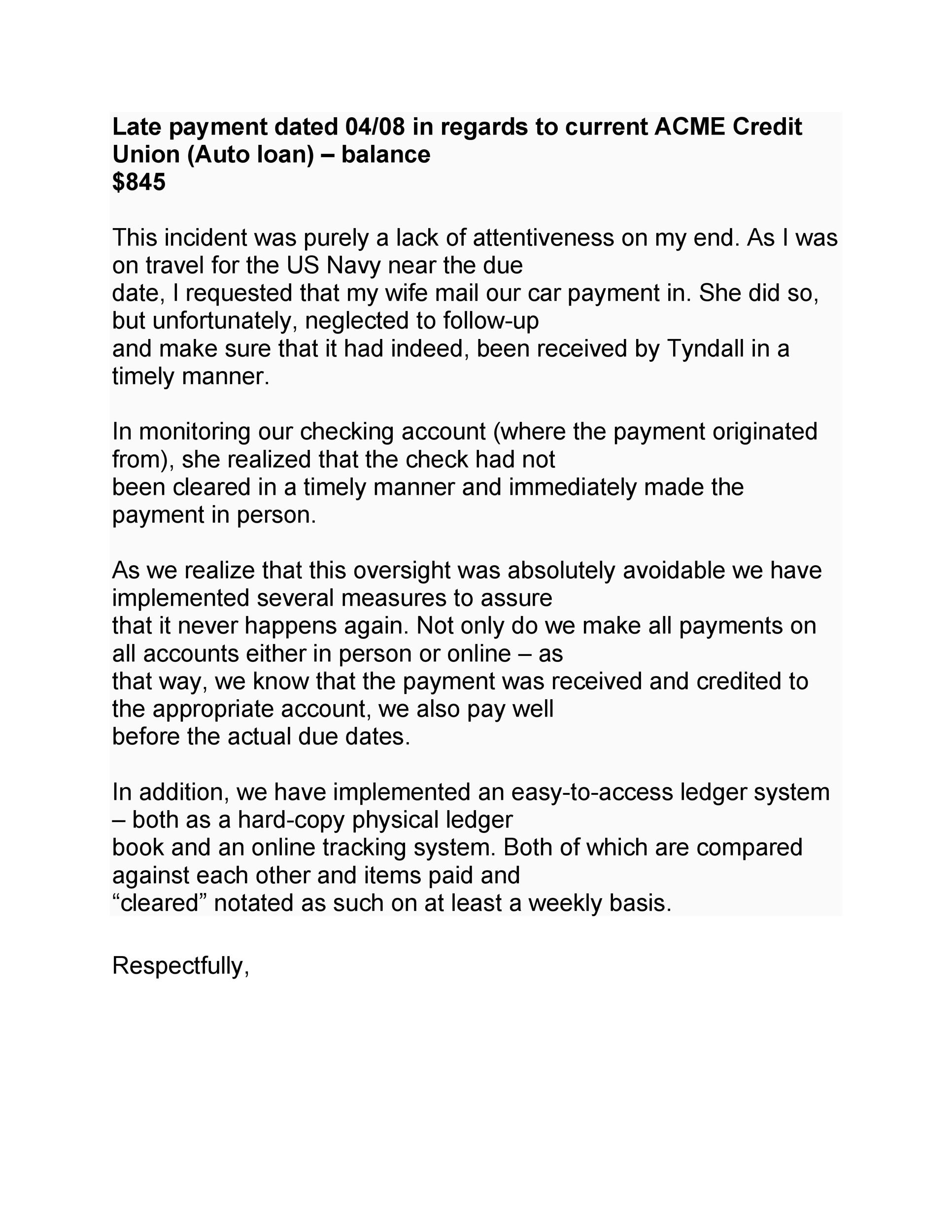

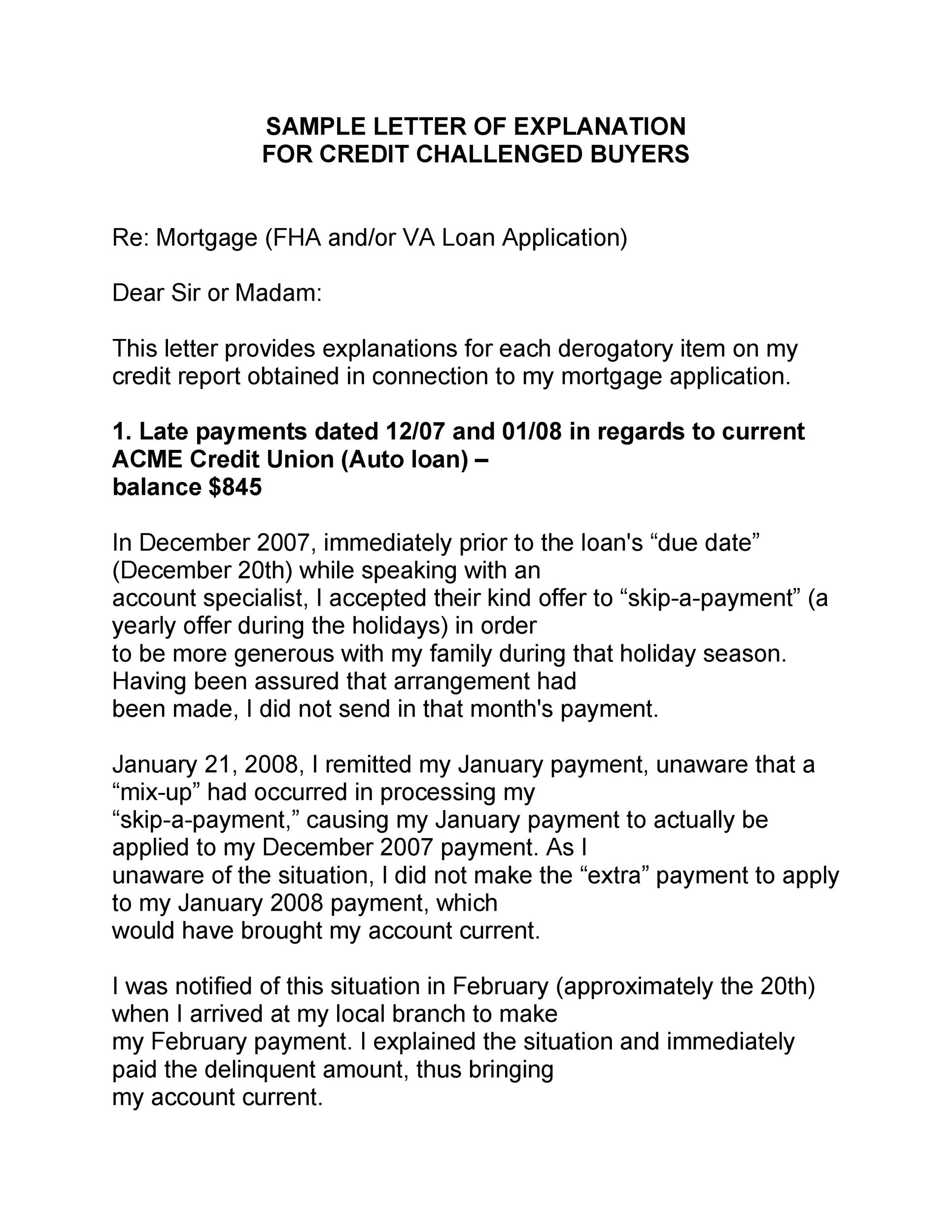

48 Letters Of Explanation Templates Mortgage Derogatory Credit

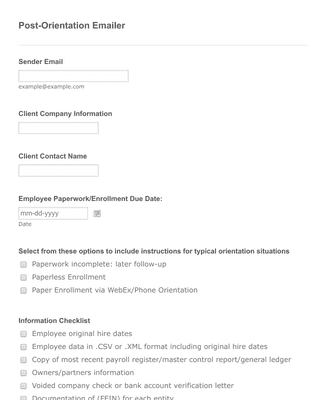

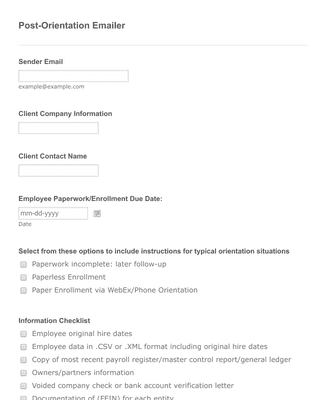

Email Template Form Template Jotform

48 Letters Of Explanation Templates Mortgage Derogatory Credit

New Irs Form 1099 Nec For Non Employee Compensation Including Directors Fees

How To Handle Ebay Taxes The Right Way In 2022

Annual Business Tax Returns 2020 Treasurer Tax Collector

Legal Incorporations Templates Format Free Download Template Net

Fintech S Fraud Problem Why Some Merchants Are Shunning Digital Bank Cards

Legal Incorporations Templates Format Free Download Template Net

Legal Incorporations Templates Format Free Download Template Net